The U.S. will close the last avenue for Russia to pay its billions in debt back to international investors on Wednesday, making a Russian default on its debts for the first time since the Bolshevik Revolution all but inevitable.

Read More: Breitbart

The U.S. will close the last avenue for Russia to pay its billions in debt back to international investors on Wednesday, making a Russian default on its debts for the first time since the Bolshevik Revolution all but inevitable.

Read More: Breitbart

The 22 trillion dollar debt of the federal government receives a lot of media attention. But this is only part of the picture. The true figure is an additional 50 trillion dollars.

When discussing America’s debt problem we have to also consider: corporate debt, which has doubled since the last financial crisis; consumer debt, accounting for $13 trillion; and state and local government debt, growing at an alarming rate.

So that is $72,000,000,000,000 and works out at $220,000 for every man, woman and child in the US.

Read More: Zero hedge

Detroit has become the latest city to file for bankruptcy, and will be the largest municipal bankruptcy in US history.

Rick Snyder, the Governor of Michigan, had been trying to broker a deal with Detroit’s creditors to restructure it’s debt, estimated to be around $18.5 billion.

However, Mr Snyder’s plans received stiff resistance from some creditors, most notably from Detroit’s two pension funds.

Mr Snyder said, “it is clear that the financial emergency in Detroit cannot be successfully addressed outside of such a filing, and it is the only reasonable alternative that is available.”

Read More: The Telegraph

Italy’s second largest Bank, Mediobanca, has warned the nation could need a rescue deal in the next six months. The economic crisis within Italy is deepening, and even large companies are feeling the effects of the credit crunch in the country.

Italy’s €2.1 trillion debt is the third largest sovereign debt in the world after the US and Japan.

Any stress in the markets could threaten to reignite the eurozone crisis once more.

Read More: The Telegraph

The annual gathering of the world’s most influential has began in Davos, Switzerland. It is thought there will be around 50 world leaders attending, including Russian President Dmitri Medvedev, British Prime Minister David Cameron, German Chancellor Angela Merkel, and Italian Prime Minister Mario Monti. There will also be leaders from the media, business, and academia.

In the run up to the conference the founder of the World Economic Forum, Professor Klaus Schwab, has said the mood this year is more optimistic than last, but has warned that the global economy could still collapse if more is not done to promote growth.

On the agenda will be the continuing eurozone crisis, the US Fiscal Cliff, weak economic growth, soaring national debts, and the latest stimulus program in Japan.

The World Economic Forum seeks to promote a global governance platform to address the global issues that national governments alone can not tackle.

Angela Merkel recoils from Greek showdown on Spain contagion fears – Telegraph.

The German Chancellor Angela Merkel has been visiting Athens today, for the first time in three years. She comes at a time when Greece is looking for the next €31.5bn tranche of aid. Without the aid Greece will run out of money by the end of November. Recent figures show Greece has been in recession for 5 years, it’s economy has shrunk by 22%, and youth unemployment is currently at 55%.

Mrs Merkel was met with angry protestors and required 6,000 police officers to protect her. Greeks, and the Greek media, greeted her with Nazi insults.

Both the EU and IMF have been insistent that Greece steps up austerity measures in order to receive the money. However, Mrs Merkel came to Athens with a softer tone than Athens has previously heard.

There has been mounting pressure on Germany not to allow Greece to default, thus forcing her out of the eurozone. If Greece were to exit, then Spain would likely follow, and the euro would break up. Also tougher austerity measures could result in the collapse of the pro-Europe ruling coalition. If the Greek government collapses it would likely be replaced by either a far-right or far-left alternative. That could destabilise the entire region, affecting the Balkan region and Turkey, something no one wants to see.

It is likely Greece will receive the next instalment of money, however the €31.5bn will only keep Greece afloat a few more months. And as time passes both Spain and Portugal are edging closer to requiring more bailouts.

Tomorrow evening will see the first of the live debates between President Obama, and Republican hopeful Mitt Romney. It is believed the debate will centre on domestic matters, in particular the size of the American debt.

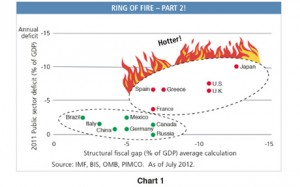

PIMCO (the world’s largest bond fund) chief, Mr Gross, said that the United States must cut spending or raise taxes by 11pc of gross domestic product GDP over the next five to ten years, in order to preserve it’s role as a financial safe haven.

PIMCO (the world’s largest bond fund) chief, Mr Gross, said that the United States must cut spending or raise taxes by 11pc of gross domestic product GDP over the next five to ten years, in order to preserve it’s role as a financial safe haven.

If we continue to close our eyes to existing 8pc of GDP deficits, which when including Social Security, Medicaid and Medicare liabilities compose an average estimated 11pc annual ‘fiscal gap,’ then we will begin to resemble Greece before the turn of the next decade,”

The warning comes after Moody’s has also warned the US that if it fails to control debt, then it will loose it’s AAA rating.

via PIMCO: America could resemble Greece before 2020 – Telegraph.

On Friday, Congress was notified by the Obama administration that it would be sending $450 million to Egypt. This $450 million is part of a $1 billion package that Obama had pledged to Egypt in 2011 for debt forgiveness to the United States.

The administration however has met resistance.

The direction of Egypt’s course under the Muslim Brotherhood, its policies, local protests against the American Embassy located in Cairo and how the Obama administration has handled crisis in Islamic regions has left some wondering why the US continues to send aid.

Kay Granger, a Texan Republican who is chairwoman of the House appropriations subcommittee that is responsible for managing foreign aid, said that she would block this aid distribution.

The US relationship with Egypt “has never been under more scrutiny” than it is now. Granger goes on to say, “I am not convinced of the urgent need for this assistance and I cannot support it at this time”.

However, Hillary Clinton speaking in New York on Friday, indicated that the world should do more in supporting the regions that have experienced the ‘Arab Spring’ uprisings.

This debate comes at a time when Egypt is in an economic crisis. They are currently facing a $12 billion deficit in their budget.

The Euro, sitting at $1.2936 against the US dollar, is the highest it has been in four months. This follows a German Constitutional Court approval of German rescue and maintenance of the Euro.

The conditional approval has lowered fears for the region’s debt problem.

This new perspective has lifted global stock values and has also reduced Italy and Spain’s costs to borrow.

Source Euro advances to four-month highs vs. dollar on German ruling | Reuters.

The controversial British historian Niall Ferguson has used a cover piece in Newsweek magazine to argue that it is time Obama “hit the road”. In the piece Ferguson compares Obama’s pre-election promises with his record as President and then argues why he believes it is time for a new President.

The economic historian and Fellow of Harvard University, has spoken extensively about the need for economic reforms and the unsustainability of western debt. Ferguson writes:

“Welcome to Obama’s America: nearly half the population is not represented on a taxable return—almost exactly the same proportion that lives in a household where at least one member receives some type of government benefit,” Ferguson writes. “We are becoming the 50–50 nation—half of us paying the taxes, the other half receiving the benefits.”

Recently Ferguson raised eyebrows by claiming if young America knew what was good for them they would all join the tea-party.

Ferguson uses the lessons of economic history, to inform his political analysis of current events. He has been an advisor to politicians in America as well as in the UK. He teaches on the rise and fall of civilisations throughout history, and although he has not written America off, he understands that she is in a perilous place, and her place as the leader of the free world should not be taken for granted – America could fall, like many great nations before her.

Spanish bail-out impossible’, experts warn – Telegraph.

As the economic situation in Spain worsens by the day, many think it is only a matter of time before Spain will need a full bail-out.

However, economists looking at Spain’s borrowing needs, their crippled banking sector, and their ailing economy now believe the required bail-out would be more than the eurozone could manage.

Head of economic research at Open Europe, believe Spain will require around €650bn.

The situation may force Germany into finally deciding whether to work towards the break up of the eurozone, or the pooling of all the eurozone sovereign debt. The pooling of the debt would lead to a full economic union, and inevitably to much stronger political ties. With Greece likely to require yet another bailout before the end of the year, and the fall out from the current situation nudging Italy ever closer to the economic death spiral, it is only a matter of time before Germany will have to make some very difficult choices. The question is will the people of Europe accept the outcome, whatever that may be?

It seems a week does not go by without more pictures of Greeks rioting and protesting their current economic situation. Just this week the Greek Prime Minister has said that Greece is in the midst of a Great Depression.

Now economists are looking closely at the French economy; France numbers are pointing towards the same outcome as Greece. France currently has an eye wateringly high debt to GDP ratio: 86.1% of GDP (146% if ECB liabilities and bank guarantees are included). Although the UK and America have similar levels of indebtedness they have the mechanisms to do something about it. They also have far more political will to change the socialist policies causing the problem.

In France there is no political will at present, to change the labor laws, and encourage free enterprise. Since coming to power in May, Francois Hollande has already reduced the pension age, increased taxation on the wealthy, increased public spending, and increased the money governments are to pay to the EU. He has also opted out of EU regulations to cap nations budget deficits.

If France continues on this present course the economic death spiral seen in Greece will come to France some time soon.

For more analysis of the situation see The Telegraph

EU leaders seek to avert euro collapse at key summit – EUROZONE – FRANCE 24.

As the European Union summit begins, the ongoing crisis will dominate talks. Ahead of the summit Angela Merkel has already ruled out the introduction of Eurobonds, saying that the appropriate measures are not in place for such a move.

Europe appears more divided than ever, with Spain and Italy calling for EU help to bring down their high borrowing costs; and Angela Merkel dismissing their calls for assistance.

The German’s are worried at French calls for debt polling, instead of focusing of debt reduction. Angela Merkel said, “I fear that at the summit we will talk too much about all these ideas for joint liability and too little about improved controls and structural measures,”