PIMCO (the world’s largest bond fund) chief, Mr Gross, said that the United States must cut spending or raise taxes by 11pc of gross domestic product GDP over the next five to ten years, in order to preserve it’s role as a financial safe haven.

PIMCO (the world’s largest bond fund) chief, Mr Gross, said that the United States must cut spending or raise taxes by 11pc of gross domestic product GDP over the next five to ten years, in order to preserve it’s role as a financial safe haven.

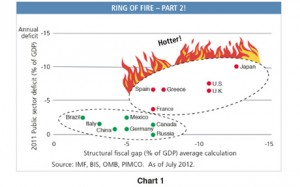

If we continue to close our eyes to existing 8pc of GDP deficits, which when including Social Security, Medicaid and Medicare liabilities compose an average estimated 11pc annual ‘fiscal gap,’ then we will begin to resemble Greece before the turn of the next decade,”

The warning comes after Moody’s has also warned the US that if it fails to control debt, then it will loose it’s AAA rating.

via PIMCO: America could resemble Greece before 2020 – Telegraph.

This is truly crazy. The US is spending its way to kick start the economy but this is just adding to unimaginable debt. Both China and Japan hold a trillion dollars in US treasury bills which they can use as economic weapons should they decide to cash them. It is like the wealth of America is bleeding.

Getting into debt was never a good idea in the first place, it is just just unbiblical. The US has gone from being the worlds biggest lending (creditor) nation to the world biggest debtor nation in a space of half a century. We have lost our strength and we are no longer the dominating economy we once were.

This AAA rating is meaningless. No matter what they ratings agency says, the US will always have the most trusted economy and currency. When all else fails, people will flock the dollar as a last resort.

If Obama wins, he sure will seal our descent to a Greek like state.